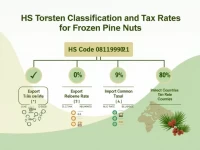

HS Codes Tax Rates Detailed for Frozen Pine Nuts Trade

This analysis delves into the HS code 0811909021 for frozen Korean pine nuts and its related tax rates, including export duties, value-added tax, import rates, and regulatory conditions. It aims to provide exporters with comprehensive market insights to facilitate successful international transactions.